wet Dreams? Part 3

04 Sunday Feb 2018

Written by parry034 in Budget/Financial, Parry Sound, Reflections

Tags

Archipelago, Capital Investment, Carling, Infrastructure, McDougall, McKellar, Opinion, parry sound, Pool, Seguin, Taxes

Share it

Swimming in Numbers.

In the end it’s about the numbers. There is no question in my mind that there is no one against a pool, aquatic centre or athletic complex on the basis of its contribution to the community. There may have been people for and against the Walmart on principle and not numbers. And there were people for and against fluoridation, and the numbers didn’t really matter. In the case of a pool it’s all about the numbers at the council level.

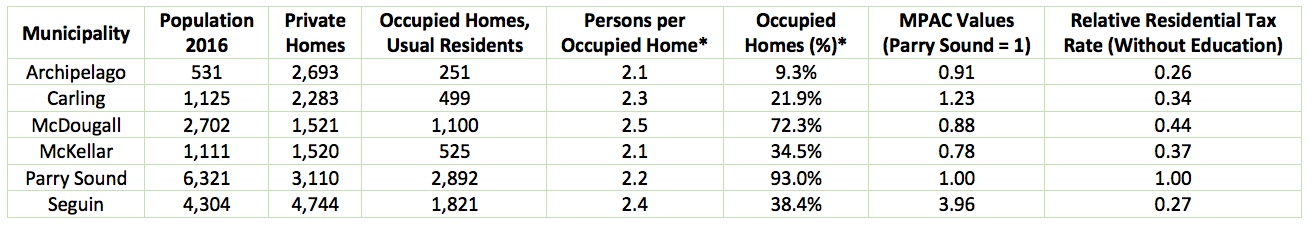

Let’s start with some numbers. These numbers can be used to tell any number of stories, but we will focus on only a couple that are relevant to a municipal pool.

The numbers in the table above are derived from a few sources, notably StatCan, MPAC, and individual municipal budgets and tax rate bylaws. The Occupied Home figures from StatCan, basically tells you how many of the properties are not used seasonally, that is they are residents and not cottagers. The MPAC Values represent the property values in the various municipalities. To make things a little easier to digest I have normalized the figures with the Town of Parry Sound being set at 1. That means all of the properties in Seguin have about four times the values of those in Parry Sound. McKellar property values total about four fifths that of Parry Sound. Some of these numbers may be surprising. Tax rates are similarly expressed relative to those of Parry Sound. For example, a person in Parry Sound paying $2,000 of municipal tax on their property would pay $540 in Seguin for a property with a similar MPAC assessed property value, $740 in McKellar and $880 in McDougall. This does not include the education tax levy which is the same in each municipality. The education portion represents about 10% of my total tax bill in Parry Sound but would represent about 35% of the tax bill of someone in Seguin or the Archipelago. We pay exactly the same rate for education taxes, but it ‘hurts’ more in a relative sense in the other municipalities.

If this is the financial backdrop for a pool project, it’s important to understand the implications for each of the municipalities. I have a pretty good idea of the more important considerations in Parry Sound and will imagine some of the dynamics and concerns in the other municipalities. At this point Carling, McDougall and the Archipelago have expressed initial interest in a municipal pool project. McKellar has declined to participate. Seguin has not yet responded as far as a I know, and I believe Parry Sound has not committed but is likely to agree to participate in looking at the options.

Town of Parry Sound

Parry Sound Town Council is generally in favour of a pool if it can be done as part of an equitable long-term sharing agreement with the other municipalities. Going alone would increase the Town levied taxes by about 12% as mentioned in an earlier post, and these taxes are already four-times that of Seguin and the Archipelago.

The Town is likely to have other concerns that would need to be addressed in any agreement. It’s obvious the pool would need to be in Parry Sound, if only for access to a secure supply of treated water. None of the other communities would be able to provide this service and the cost of building and operating a treatment facility would make the pool project too expensive. But, the Town has concerns about losing a portion of its water treatment capacity to a project that will not generate revenue. Who pays for additional capacity if at a later date capacity equivalent to that used by the pool is required for development?

There is also the prospect of losing prime real estate to another project that will not generate property taxes. The Town now has more than two dozen facilities occupying prime real estate that don’t pay taxes. This includes churches as well as social service and medical service providers. These groups enhance the quality of life for Parry Sounders, but they also enhance the quality of life of those in the surrounding communities. These facilities make use of, and raise the cost of, tax subsidized services, increasing the load on tax payers of Parry Sound.

Would a consortium of municipalities be willing to give Parry Sound a credit on the tax assessed value of a municipal pool? Assuming an ‘assessed’ value of $11+ million for a pool would suggest that if it were a business or residential property it would pay about $150,000 in annual municipal taxes. Would the consortium be willing to credit the Town that amount against their contribution? Oh, oh, I hear the howls already!

For Parry Sound a pool is not that interesting unless acceptable terms were negotiated. What might be acceptable to Parry Sound might not be acceptable to its neighbours.

The Archipelago and Seguin

I am lumping these two together because they largely share the same interests, although they might not share the same ways of thinking.

Issue one is the tax payer. The majority of Seguin and Archipelago taxes are paid for by seasonal property owners. What they want is limited services and low taxes. They are paying two sets of taxes, one for their home in ‘Hogtown’, and another for their cottage in ‘God’s Country’. They don’t need a pool, they have one they are already paying for back home. These are informed folks who do not want to pay for anything more than is absolutely necessary to ensure a road to their cottage, and rules to prevent their neighbour from building a bigger dock or ‘bunkie’ than they have. And when it comes to roads they are already paying for that last ‘mile’ of driveway to access their ‘cottage’.

There are still folks in both municipalities who live, work, and contribute to the larger West Parry Sound community. In principle, they probably would like a pool, but not if it costs that much. It’s a bit different depending on whether you live in The Archipelago or Seguin. Archipelago residents really have only one choice where to go for shopping and services – Parry Sound. Sudbury, Huntsville and Bracebridge are a bit too far. For Seguinites it’s a bit more nuanced. Given the proximity of Huntsville and especially Bracebridge, it becomes a toss-up as to whether you drive to either one of those towns or Parry Sound. It may not even be a toss-up for those in Rosseau. Once you’re in Bracebridge for a pool you have more options in terms of their recreation centre and shopping. Pay more taxes for a pool in Parry Sound that you won’t use? The eastern Seguinites will probably say no. For those in Orrville a Parry Sound pool might be desirable, if they think they will use a pool. Not all will. The situation for Archipelagians is more obvious if they want a pool. That may be why they have expressed initial interest in a community pool discussion.

Both communities offer their seasonal residents the lowest taxes possible. These are the municipalities that boast multiple multimillion dollar properties. A quick look online revealed numerous, and I mean numerous, properties with valuations in excess of $5 million each in Seguin. That $5 million dollar ‘cottage’ would pay about $18,000 in Seguin taxes (not including education taxes). Raising their taxes 2% would mean an additional $360 in taxes. That might mean foregoing a couple less bottles of fine wine, probably very fine wine. When you make this type of money though, a dollar spent on something you really don’t want hurts more than you might imagine. And if it hurts they squeal. With a ward system they have ears to squeal into.

Carling and McKellar

I’m lumping these together to save words even though McKellar has declined participation. The situation these municipalities share is similar. Heading off to Sudbury or Muskoka for a pool is not really practical. At the same time, they both have more than two-thirds of their property value owned by seasonal residents and face the same issues discussed with regard to Seguin and the Archipelago.

The property values in both of these municipalities approach but don’t come consistently close to the stratified values of the Seguin and Archipelago properties. Seasonal residents of both municipalities are likely to pushback against any increase. Perhaps in anticipation of this McKellar’s council has already declared their lack of interest and retreated to their bunker.

McDougall

McDougall is much like Parry Sound in many ways, but not all. If you have driven along Big Sound Road you realize that there are a number of million dollar plus properties, just not the multimillion properties of Seguin and the Archipelago. Parry Sound does not have these types of properties, which may explain why the ‘rich folk’ who work in Parry Sound don’t live in Parry Sound. Taxes in McDougall are also the highest in the area, but still less than half of Parry Sound’s. It’s an easy ride from McDougall, at least the major population centre of Nobel, to Parry Sound for shopping and making use of a municipal pool.

Who Pays What?

This will certainly be a point of discussion and probably disagreement. Do you share expenses on the basis of permanent population, seasonal plus permanent population, private dwelling numbers, or MPAC assessment? I’m sure the lower tax municipalities, with higher assessment values and lower populations, would prefer a population-based sharing. Parry Sound would prefer an assessment-based allocation.

Both methods of allocation are currently being used. Belvedere Heights allocates municipal contributions on the basis of MPAC assessed property values. By this measure Parry Sound, The Archipelago, McDougall and McKellar all pay about the same, plus/minus $15,000. Carling pays about $40,000 more and Seguin pays about four-times as much. This is because Seguin in particular has a massive assessment base with all of those multimillion dollar ‘cottages’.

The Reginal Health Unit on the other hand allocates municipal contributions on the basis of the MPAC 2014 population count. This makes the Town of Parry Sound the largest contributor, while the Archipelago pays next to nothing. This makes sense as health services are delivered on a per person basis, although it is likely our ‘summer visitors’ and cottagers make considerable use of the hospital, albeit not so much the health unit services.

Playing Arbitrage

The situation with McKellar is interesting to think about. They have expressed no interest in a community pool, but could we deny McKellar residents the right to use the pool? Probably not. We would just need to charge a premium for those who want to use the pool but whose municipality doesn’t provide support. It’s a tricky situation. We are likely to have visitors interested in using a pool. Some will be tourists with no relation to the community and there will be others who are friends or family of area residents whose municipalities contribute to the pool. Charge too much and the Town looks like a money grabbing community, charge too little and it will make it cheaper for other municipalities and their residents to not participate in supporting the community pool. But then again, any additional revenue is probably ‘profit’. What is the additional cost of ten visitors compared to the corresponding dollars of non-resident income?

Let’s look at the McKellar situation as an example of what communities might want to think about. If McKellar were to participate in the pool they would probably be on the hook for about $85,000 per year (permanent population basis). That would raise their taxes by a bit less than 1.5%. On a property value basis, let’ assume that for a $250,000 property, not a high-end cottage, this would amount to an increase of about $18 per year. In exchange for this the resident could purchase an annual pool pass for let’s say $1,000. Also assume the non-resident rate is $1,400, a 40% premium. For that person having McKellar in the consortium is a big savings. It’s likely that it would be a break-even event for residents if they were only to use the pool twice a year and pay a resident as opposed to non-resident single visit rate.

What about McKellar as a whole. I would be surprised that if more than 30 pool memberships were sold to McKellar residents. That would bring in $30,000 of revenue as a ‘resident’. The non-resident rate would bring in $42,000, a difference of $12,000. That’s not close to the $85,000 it would cost McKellar to participate in the consortium. McKellar would be better off reimbursing pool users the $400 cost of a non-resident membership. It would raise taxes only a fraction of a percent if the amount couldn’t be found in petty cash.

That’s what arbitrage is all about, capturing profit by exploiting the difference between prices in different markets. In theory at least, it could work to the benefit of a community like McKellar to sit outside. It would be hard to refuse McKellar residents access to the pool because McKellar isn’t party to the pool partnership or charge them the appropriate premium to cover the real benefit they are receiving.

Final Thoughts

The numbers and the individual interests of municipalities are what will drive the decision. Understand the numbers and you can perhaps better anticipate and address concerns at your local municipal level.

There is also a social issue that needs to be addressed. A municipal pool is not like roads or health services that we all use in one way or another, even if we don’t have a car or never get sick. I’ll take a look at that in the next and final installment.

No comments

February 4, 2018 at 6:47 pm

It is 50 miles to Bracebridge. Why not offer to pay Parry Sound residents a portion of their travelling costs to access the Aquatic center over there instead of building one here? The cost savings would be enormous. Parry Sound residents access Medical services in Orillia (me), Barrie (me), Toronto (me), Sudbury (me) because the Health care system cannot be all things to all people in Parry Sound. Residents also travel to Toronto to access entertainment services, etc., not available here. Likewise, Parry Sounders beat a path to Costco in Barrie because it is not profitable to build one here, so why can’t the handful of potential users of a swimming Pool not do the same. I have 2 family members who purchased vehicles in Bracebridge and travel there for Service. I travel to Alves Motors for auto Service and to Orillia once a month for eye care. Rep Hockey teams travel all over the District and pay for expenses out of pocket. If we are to build a Pool in Parry Sound, you can bet that people will travel the 50 miles from Britt to access it.

To build a new school complex, at the same time as a new swimming Pool complex, and not find a way to combine the two facilities together in one location is stupidity of the highest order in my opinion, but it will probably happen. fwiw