taxes that is, especially for those of you who owns a condo.

For condo owners it’s a case of good news and bad news. The good news is that the value of your property as assessed by MPAC (Municipal Property Assessment Corporation) has increased substantially over the past four years. The bad news is that almost all other properties in Parry Sound have decreased in their assessed values, meaning more of the tax burden is being shifted to condos.

For residential property owners the news is not so good, and not so bad. Property values on average have dropped, and taxes are going up, but not as much as for condo owners.

For business property owners (Commercial) the news is not so good, and good. The not so good is that the assessed values for business properties have in general dropped significantly, translating into a lower average tax increase. The big box stores who appealed their assessments at the provincial level have seen their local property values drop significantly. For businesses the drop in property assessment values really is good news in that it stabilizes property taxes in a tax increasing environment. Since business sale prices are based on revenue and profit, not property assessment values, the reduction in commercial assessments actually improves the bottom line, and eventual sale prices.

For the Town of Parry Sound the news is not so good; overall assessments are down and unless expenses can be trimmed the burden of taxes needs to be shifted.

For condo owners there is a bit more news, good and bad. Increases in assessed value on properties are phased in over four years, not in the first year. That means if your property was previously assessed at $100,000 and the reassessed value was $200,000 (you wish, but it makes for simpler numbers), your assessed property value for tax purposes would rise to $125,000 in the first year, $150,000 in the second, $175,000 in the third and $200,000 in the fourth. Because of this provision it means your property values, and taxes don’t go up by the full reassessed value of $200,000 in the first year. The bad news is that your property taxes will increase in each of the next four years because of the increased assessed value of your condo, in addition to the Town’s annual spending increase.

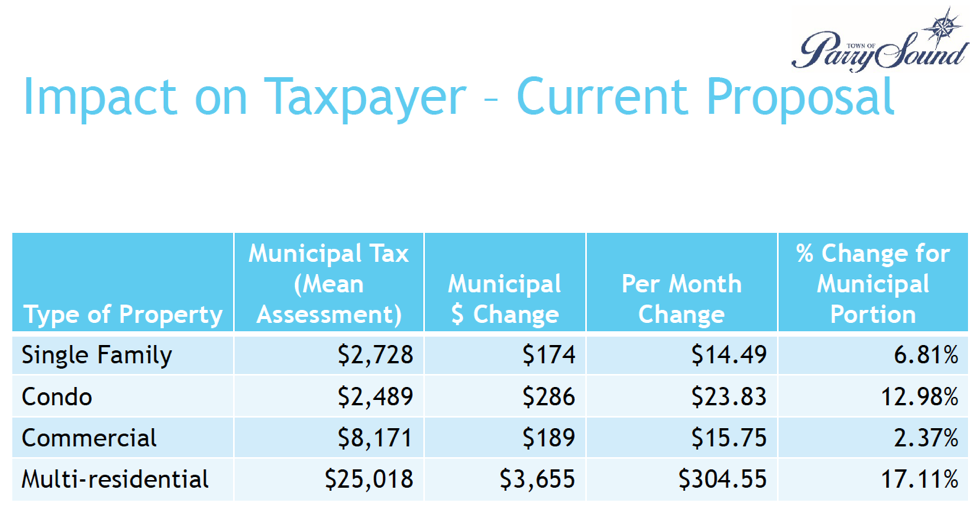

How does this all translate in terms of tax increases for 2017 in Parry Sound? The table below if taken from the Staff presentation to Parry Sound Council December 13, 2016. The figures are based on the current budget as proposed by Staff. It’s possible that these figures could go up, or down, by 1% depending on decisions still to be made by Council.

I have been laisez faire with respect to Parry Sound budgets for the past few years, figuring the new expenses were related to necessary items and services. I feel that if you need new snow tires for your car you probably want to buy them before you have an accident that will cost even more, even it requires a loan. But, do you need to take out a loan for that week in Cuba or Costa Rica, or a new snow machine, or ATV? There is need to spend, and nice to spend. Based on budget meetings to date I’m not sure that Council is paying attention to the difference. At the last meeting of Council a new ’music garden’ park was approved, and I really don’t get it. Yes, it is a nice to have, and yes, much of it was in the reserves, but what about next year if/when one of the existing parks needs some significant repair or it needs an upgrade? As a municipality have we sufficiently satisfied our needs that we can afford to be looking at 2%, 7% and 13% tax increases to support nice to have budget items?

Parry Sound is figuratively taking a pay cut in 2017 because of the MPAC reassessment. Actually it really isn’t a pay cut, it’s a redistribution of who is carrying a larger or lesser portion of the overall tax burden. Condo owners are taking on more, and business owner’s are taking on less. It’s likely that condo owners who are facing an average 13% tax increase in 2017 could be facing 50% higher taxes in four years than they were in 2016 by the time all four years of the reassessed condo value has hit their taxes. Ouch!

I don’t own a condo, and I don’t necessarily think they should be given a ‘break’. Their properties have increased in value and that means they should pay more. I pay more in taxes than some of my neighbours because I have a higher assessed property, and that seems fair. I do think that Council needs to pay attention to what is necessary and what is nice in the budget. Over the past few years they have been remarkably ‘generous’ in their approval of expenses that are more nice to have than need to have. I labeled the 2016 Parry Sound Budget the ‘pickle ball budget’ because budget was allocated to organize pickle ball play, among other recreational activities. I’m not sure that we saw any pickle balling, but it was one of the many reasons for last year’s tax increase. Is pickle ball, or any number of other items in the 2017 Budget, something we need, or are they things we want? Do we even want these nice to have items?

Is anybody else paying attention to the Parry Sound budget? Council is made up of good people who want to do the right thing, and not feel as though they are a Grinch stealing joy from the residents by cutting services or rejecting new initiatives. They need your input to understand what you feel is need to have and what is nice to have. Here are links to the various budget documents. At least look at the Capital Budget Overview and Tax Impact Presentation (December 13th) to get a short overview of where the 2017 Budget stands at this point and how it impacts your property taxes.

Capital Budget Overview and Tax Impact Presentation (December 13th)

Note: not all condo owners will see the full 12.98% increase in 2017 because their condo assessment might not have risen as high as the average. Others may see an even higher increase if their property assessment increase was above the average. That will be the case for all property owners, you are seeing the average impact, not necessarily how the 2017 increase will impact you.

The Path Less Chosen. A bit more demanding but more rewarding.

No comments

December 31, 2016 at 3:39 pm

Thank you for the update. As I have said before, when spending other peoples money, rather than your own, and you are dealing with a multi million $$$$$$$$$$$$$$$ budget, the human mind, that normally deals in single $ personal budgets, becomes blurred to reality and they react in the same way as the inebriated tipper in a Hotel when dealing with a cute waitress

December 31, 2016 at 6:35 pm

The folks on Council are virtuous in that they are reluctant to grant themselves raises or expenses, even though it amounts to a few thousand in total. They also are tough on spending $4,000 for new chairs for the council chambers that should last a decade and be used by the POA Court. But $37,000 to equip a new park with musical ‘toys’ goes through with no discussion at all. This new park will mean additional work for Staff in terms of maintaining the equipment, and maintaining the grass around the toys. Will it be enough that with other new initiatives we add enough work to rationalize hiring another person? These musical toys are intended to be left out of doors, and that’s a good thing. Have you seen how the piano on the bandshell has been taken care of? It’s a disgrace. Yes, it might have been free, but that’s not how you take care of equipment. It let’s the public see the Town doesn’t care, and perhaps suggests they don’t need to either.

January 1, 2017 at 10:25 am

I think part of the problem here is the funding model itself.

What is an MPAC assessment, really?

Is it an actual appraisal of the value of your house, based on a qualified inspection of its features and construction quality? Cause, I mean, if we were getting any other object appraised, that’s normally what we’d be talking about. When you ask a mechanic to assess the value of a used car, that’s what you’re wondering: is the body full of rust and is the trany about to drop? But of course, MPAC is nothing like that. At most, they might drive by your home, but the vast majority of assessments are done sight unseen. So the MPAC assessment is not based on the actual quality of the goods. So what then?

Well, how about sale price? Could the MPAC assessment reflect what the house would sell or has sold for? You’d think that might have something to do with it, but you’d be wrong. MPAC is quite clear on their website that the assessed value is not correlated to the sale price. In our case, we paid $40k less than the assessed price, and then a year later the assessment went up to $80k more than we paid. That’s a over-under of $120k, or about 30% of what it actually cost us. If an assessed price can fluctuate from the actual price by more than 30%, I would suggest that either the assessment is utterly incompetent, or it was never intended to correlate to actual price. MPAC admits it’s the latter, and I believe them.

I could go on, but the point is that the MPAC assessment is a meaningless number. It’s not based on any point in reality. It has almost no connection to the concrete. It’s comparable to the modern stock market, where the stock price of a company almost never has any basis anymore in the actual value of the company – it’s assets or production capacity – but rather end up being based on whatever spin the accountants can fit into the quarterly report, or worse, are based on a rumour some pimply faced MBA grad on the floor heard about the CEO’s affair with the CFO, or whatever.

So what good is an MPAC number then? If I get a higher MPAC, does that mean I’m richer? Does that mean my financial status has improved? Of course not. It means nothing to me. You could tell me my house was just assessed for a million bucks, but that wouldn’t make me a millionaire. That would only mean something if, and only if, 1) I was actually prepared to sell and walk away with the cash, and 2) the market price I would get was in any way correlated to that assessment. But as we’ve seen, #2 is not true, and for most people, #1 is not true either. We all need someplace to live, so an increase to your house value is only an illusory gain in wealth, because it’s thoroughly inaccessible.

The point is, a person’s day to day finances are the same regardless of what happens to their MPAC. When your MPAC goes up, you don’t magically start having more money every month. So why on earth would we think that a person can suddenly afford to pay more taxes just because their MPAC went up? It makes no sense whatsoever. We might as well set the tax rate based on how much weight you’ve gained or lost, or whether your hairline has grown or receded.

There are better ways, which I won’t ramble on about now, but suffice to say, any funding system based on something so arbitrary and senseless is all but guaranteed to be unjust in it’s application and ultimately create just as many problems as it solves.

January 2, 2017 at 11:51 am

Not having worked with a property assessment group I understand the process of assessment involves gathering information about the size of the property, the square footage of the buildings, the number of toilets (an indication of occupancy/usage), the usage of the square footage (occupied, empty, storage), etc. Then factor in the ‘amenities’ of the property, in our part of the world that would include water frontage, a big value add, or in the case of a rail line in the backyard it means a drop in valuation. Take all that information and correlate it with the current selling prices of comparable properties and MPAC has an assessment value. Presumably, if the value of properties in a certain area all go up as determined by real estate sales, that means their assessment goes up. This will impact the sold properties as well as all others. A rising tide lifts all boats, even if they are happy with where they are.

But as you have noted the assessment value is not necessarily the selling price, but I suspect that the relative assessment prices are in line with the actual ‘market’ prices. It could be that MPAC has a ‘policy’ to assess properties at about 80% of the current selling prices. Or it could be that over time it has slowly migrated to that point. There is some value to them stating that they don’t price to actual sales prices. To do so would imply and demand an unreasonable degree of precision we aren’t willing to pay for. Since municipal taxes are paid according to assessment, and if all assessments are at 80% of their ‘true’ values, then the taxes due would be consistent with the market values. The only thing that would be higher than necessary would be the levy, let’s say 1% of assessed value, rather 0.8% of the ‘true’ value, but that doesn’t change the taxes you and I pay.

Your 2016 assessment was probably based on the 2012 value and adjusted by checking to see what improvements (building permits issued) were made to the property, what it might have been sold for, what happened to prices in the neighbourhood. It’s a bit like grading students on a curve. The absolute value of their test score is less critical than the general performance of the class and the relative performance of the student. In theory, a student could get only 10/40 answers correct on a very tough test, and still be assigned a C. If the process is consistently applied, it works for the purpose of fairly assigning taxes.

Property values are much like the value of stock holdings. If your stock portfolio went up $2,000 in the past year, you are in theory $2,000 richer. But you only realize the value if you sell the stock. Housing is the same. The only difference is that you are assessed an annual tax on the property but not the stock (well actually you effectively are if you hold your stock in a mutual funds and have a 2% or so ‘management fee’). Property taxes are one of the few ways to tax wealth in addition to income. Property taxes also are more transparently applied, you see the roads being cleared, it’s less obvious where income taxes are applied. I actually think property taxes are okay as it doesn’t drop the burden of taxation solely on working folks, and spreads some of the cost of to the older generation who have stopped working, are living off their wealth, but still consuming services.

In an interesting case in Vancouver a couple of months ago a residential property valued at let’s say $800,000 for the past decade found their assessment raised to something like $3 million. There had been no change in the property or even the neighbourhood, outside of the usual Vancouver price increases. The change was because the assessment group felt that the property had the potential to be annexed to a neighbouring property that could then be turned commercial and sold for a much higher value. So, they assessed it at the higher valuation because it could potentially be sold for much more for a different use. The commentary suggested that the owners were unlikely to get a reversal of the assessment. Now that would hurt.

I can be tough on any number of issues, but when it comes to MPAC I feel they do a pretty good job of managing a necessary and unpopular service. They certainly aren’t stupid, they just don’t have the resources to do concierge type service that we might like but aren’t willing to pay for.

January 2, 2017 at 11:22 pm

Jo, it sounds like you’re still accepting the premise though, and that’s the thing I really reject.

Certainly, citizens should pay taxes to support the services of their town. That’s something I will happily (er, not really so happily, but you know what I mean) grant you.

Just like it’s only fair and right for us to pay taxes to the other two levels of government which serve the people.

The basic idea of tax and the justification for it is quite easy to accept.

But while most people accept that citizens should pay taxes, most people also agree that the tax system should be fair and equitable. People should not be taxed unfairly.

Aside from consumption based taxes – which, as you’ve often rightly pointed out, are inherently fair because they only apply to users – all of our other tax systems though are based on a person’s ability to pay. The principle of fairness dictates that a person should not be taxed for more than they can afford to pay. That is why the federal and provincial tax systems are based on income, with different rates for different income categories, and include (arguably too many) exemptions and credits to excuse income which, for whatever appropriate reason, should not be counted as taxable. Setting your tax rate based on your actual income is, I think, the closest we can get to the ideal of a fair and just tax system, because it (usually) ensures that a person is not taxed greater than they can afford: it levies more tax on those who have more money, while requiring less tax from those who have less money.

In comparison, the municipal tax system, based as it is not on your actual income but on the assessed value of your home, is almost guaranteed to be unfair. Even if the assessment was accurate – and I still maintain it is not – the system would still be unfair, because the value of your house is simply not correlated to your ability to pay. Again, the value of your house simply does not provide any reliable indicator of how much tax you can afford to pay.

Yes, there might be a lose correlation in some cases, in that a lot of rich people will be able to afford a big rich house, and most big rich houses will get a high assessment, and thus those big rich people will get a big tax bill – so yes, sometimes it will work out. But some times – and I would argue most times – it does not.

People inherit houses, and thus the fact that they have a house worth X number of dollars does not imply that they have that kind of money.

People pay off their houses, then retire to a fixed income, and thus the value of their house might indicate what type of money they once had, but they no longer have that kind of income at all.

People routinely buy more house than they can afford – a problem aided and abetted by banks which approve people for too high of a mortgage – and then end up “house poor”; they may own a high-value house, but that’s where all of their money is tied up, and they have none to spare between paycheques.

People are often helped out by friends or family to buy their house, and thus the value of the house is, technically, not an expression of their income level only, but rather an expression of the combined income of themselves and the people that helped them.

I could go on, these possible scenarios are endless. The bottom line is that the value of your house – even if it was accurately assessed – has no necessary correlation with your income level. By using house value as the basis for tax assessment, we are therefore setting a person’s tax rate with no concern for whether the resulting tax bill is at all correlated with their ability to pay. This flies in the face of how we normally assess tax, and usually results in tax bills which are unjust and unfair. A rich person will get off with paying far less tax than they could afford to pay, just because they happen to live in a smaller house. A poor person will end up with a much larger bill than they can afford to pay, because they happen to have a better house. That kind of inconsistency is not how a tax system should function.

The unfairness of it is particularly heinous in that your assessment is in constant fluctuation without any connection to your income. With federal or provincial tax, your tax assessment only rises as your ability to pay rises. With this cockamamie municipal system though, your tax assessment can jump based on all manner of unforeseen factors that have nothing to do with your ability to pay – such as that potential development case you mentioned. This can leave people in the astoundingly unjust situation of losing their home despite having responsibly purchased within their budget, all because some other unrelated factor suddenly dictates that their house value has risen. What kind of society lets people lose their homes in that way? Not a just society.

Where this idea of basing the municipal tax on the value of your house came from, I’ll never know. They might as well base it on the number of hairs on your head, for all it has to do with ensuring a fair tax burden.

The municipal tax system should be based on income, as all of our other non-consumption taxes are.

January 3, 2017 at 9:42 pm

In the end income tax is a tax of income. People have options to ‘hide’ their income, especially in some southern European countries that are suffering financial crises. Property tax is a tax of wealth, of sorts. People actually have options. They can choose to live under their wealth in a smaller house with less land. Or they can choose to move to a lower tax municipality. If you move to Seguin you will pay about 1/3 the property taxes of Parry Sound. I’m not complaining about that, but people do have options.

The Parry Sound Director of Finance has made a reasonable argument that the value delivered by the Town to individuals for their property tax is a relative bargain. It certainly is a bargain compared to what we pay for auto insurance.

So we as a society we tax income, consumption and wealth in a variety of ways. In the end it’s not that bad because we do have options to minimize taxes, not necessarily options that keep everybody happy in all cases, or come without some sacrifices. The system has been built over decades by smart people; I give them credit for making tough choices. We also need to make tough choices, individually and as a community. Do we really need a ‘music garden’? Do we really need an aquatic complex? Did we really need the Stockey Centre?